How Long After Denied to Ask for Credit Increase Again

It's like shooting fish in a barrel to think of a reason why a cardholder would want to seek a higher credit limit. Of course, a higher limit means more capability to make larger purchases. Information technology can even push your credit score upwards and therefore fix you up to qualify for better loan terms and credit card opportunities in the time to come.

If your carte du jour issuer does not grant an automatic credit limit increase, yous may initiate a request for a credit limit raise. Your credit bill of fare visitor will process your asking by considering your account history, income, and credit history to decide whether it's okay to give you more credit. The unfortunate truth is, not all requests go a nod – a good number of them go a thumbs down from the issuer.

When Should You Not Enquire For a Credit Limit Increase?

Your personal situation affects whether yous volition exist approved for a credit card increase or non. Effort not to employ for a credit limit increase if your credit score is only in the fair or poor range. If you take recently had late payments and high credit utilization, you lot might besides be denied a credit limit increment.

The visitor will besides check if you have recently applied for credit limits with other companies, and so don't employ for too many at i time. If you lot have recently taken a lower-paying job, yous might likewise not be able to get the credit limit increase you're hoping for.

Endeavour not to take a credit limit increase if you're virtually to take a vacation or do something else that could brand you more susceptible to spending more money. The credit limit increase might encourage you to spend more money than you have.

Why My Credit Limit Increase Was Denied?

Beingness denied a credit limit increase tin can be frustrating simply knowing the reasons why might help you to go the increase in the time to come. If you have been late making payments on the credit card within the past 12 months, y'all will probably exist denied a credit limit increment. High balances on other cards in ratio to the limit might also cause a visitor to deny you an increment.

If y'all accept recently practical for a credit limit increase on another card or your account is less than a twelvemonth former, the credit card company might consider you a risky buyer and not allow you to have higher credit.

Nearly companies want to run into that you accept high enough money to take on a credit card increase and be able to pay the extra money back on time. Having a low income might be a reason some companies will deny yous an increase.

In that location are a couple of reasons why issuers reject credit limit increase requests:

New Account

Many credit card issuers have an internal policy that precludes them from issuing a credit limit increase unless the account has been in beingness for a minimum of six to twelve months. You may discover some credit bill of fare companies that have a longer requirement.

If you've just opened your credit carte du jour account, it'southward good to expect for at to the lowest degree six months before yous asking for a credit limit increase to get a ameliorate risk of getting an approval.

Yous Have Recently Applied For Multiple Credit

If you have recent applications for whatsoever kind of credit (not but credit cards), that may hurt your chances of getting a credit limit increase. This is the general example regardless if lenders have approved those applications or not.

Recent multiple applications give the lenders the impression that you are in some kind of financial problem and is in desperate demand of a loan to bail yourself out.

Your Credit Score is Too Depression

Credit rises and falls on the credit score. It could be the nearly significant singular cistron that would influence a lender to decide quickly to grant a credit limit increase.

If you take a low credit score, the lender might conclude that y'all take other credit bug that make you a risky business relationship and therefore not worthy to receive more credit. Normally, your credit carte issuer volition send you a free copy of your credit score because they used it to decide non to give you a credit limit increase.

According to Experian, the average credit score for the United States residents was 703 across all age groups in 2019. This was only three points beneath the boilerplate credit score for people in age 50 – 59, which scored 706 points. Adults in the 20 – 29 age subclass had the everyman credit score at 662. This is xiii.14% less than those in the age group of 60+ who scored 749 points.

If y'all already have a lot of available credits and several open credit cards in your wallet, you are a credit risk considering yous could become into debt very fast.

Almost credit card issuers don't want their borrowers to exist overwhelmed with debts. It'due south non because they sincerely care about you personally, but because when you lot tin can't manage your debts, you lot may default on your credit card payments. Increasing your credit limit contributes to increasing that risk.

Low Monthly Income

The lenders assign your credit limit in relation to your monthly income. Therefore, if they perceive that your income is also depression (using their ain metrics), it volition be unlikely for them to approve your request for an increase.

Late Payments Record

Late payments tell your lender that you're having trouble managing your credit. Since credit card issuers will naturally check your credit report earlier they decide on your credit limit increase request, late payments to whatever credit card or loan can drastically reduce your chances for approval.

What Tin can I Do At present?

When your card issuer denies your request for a credit limit increase, all is non lost – you have several options bachelor. A adept jumping board is to bank check the detect of denial and do some corrective measures to accost the issues they have noted.

This may hateful finding a way to pay off some existing debt or making sure you lot pay your bills on time. Only after you've shown your creditors that you are responsibly managing your credit can you reapply for the credit limit increase.

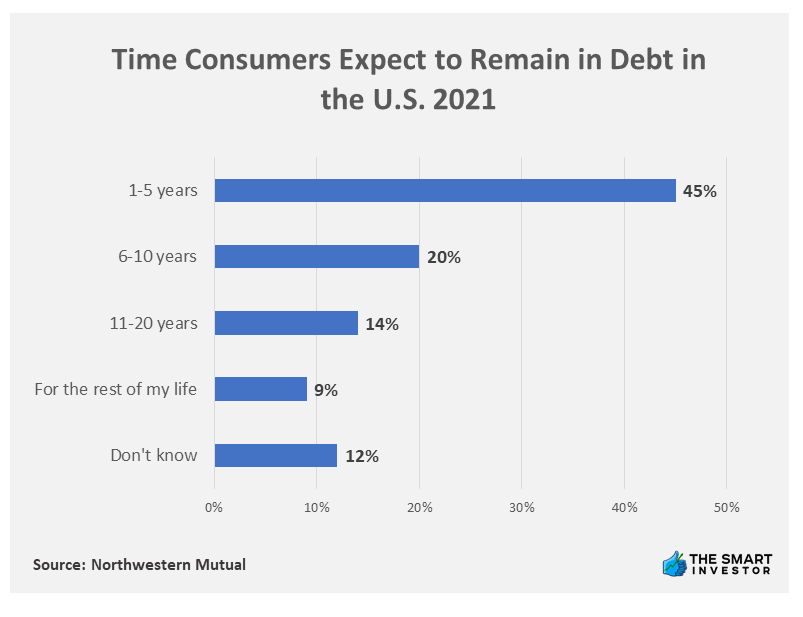

A bulk of Americans have a plan to reduce their personal debts within specific timelines, based on a poll conducted by Northwestern Mutual. 45% of Americans wait to pay off their debt in 1 to 5 years, compared to nine% who expect to pay debts for the residuum of their lives. 34% of the respondents look to pay off their debt in 6 to xx years. Only 12% of the respondents said that they practice non know how long they will be in debt.

For The Long Run

For the long run, there are structural changes you may want to practice. Consider a financial program that include:

- Cut back on your spending

Lenders won't ordinarily deny your request for a credit increase if you lot have sufficient bank residue to justify that you lot're worth the risk of receiving more credit. Show them that you're seriously managing your credit by reducing your overall spending.

- Pay your bills on fourth dimension

If this isn't the all-time way to push your credit score upwards, it's one of the great ways to increase your credit limit. By doing this, your credit card issuer volition see that you lot are a responsible credit bill of fare holder and that you use cash to pay off your card rest every bike.

The most mutual reason why lenders deny a credit limit increment is they perceive that the borrower will become a bigger gamble to the bank. It could exist considering your credit utilization ratio is leaning too far. This ratio shows how much of your available credit you have already used up. Or it could be your inconsistency with your payments.

If such was the case, a sensible creditor wouldn't invest more coin in you lot. It's strictly business from their end, it's nothing personal. The burden of proving yous are a responsible and trustworthy borrower rests on you lot.

- Use your carte du jour regularly

Begin using your carte more and more frequently. Although it might be a hassle, you should even pay your household expenses through your credit menu. Just exist sure to pay your bills on fourth dimension so that you tin establish that you are a assisting cardholder for your credit menu issuer.

- Get a copy of your credit report and check for errors

If y'all think y'all're handling your cards and other credits excellently simply still received rejection notices for the increase, the lenders may have some other reasons. Go through these questions as you wait into your credit report:

- Does it report some tardily bills or other negative marks? If they practise, are they correct?

- Are at that place any activities or transactions that you did non authorize or appear to be fraudulent?

- What is your electric current outstanding debt to income ratio?

If you see anything out of order on your report, start to gear up the discrepancies by writing to the credit bureau immediately and tell them what you think is wrong – and why it is so.

-

Look for other sources of income.

If paying your debt comfortably is already becoming a challenge, you need to increase your income. At that place are a lot of opportunities out there if you search for them. Look into unlike options, be creative and resourceful.

Y'all tin take on a roommate, drive for Uber or Lyft, list your space on Airbnb, exercise some dog sitting through Rover.com, or evangelize groceries via Instacart. These are like shooting fish in a barrel ways to make some cash without compromising your total-time job or commitments.

For The Short Run

One affair you lot could try is to apply for a different card that has a college limit. Only, brand sure that y'all stand up a big gamble for approval. If you apply for the bill of fare and the issuer turns you downward, your credit score is going to endure because of the issuer's additional hard research.

If your credit is really the issue, a secured credit menu could be a not bad option. These cards are great for people who want to improve their present poor credit to something respectable over fourth dimension (Bank check out Capital One Secured Mastercard or Discover Information technology Secured). The lenders give a credit limit under $ane,000 and would require you to put downwardly a refundable deposit when you sign upward. This lessens the run a risk that the card issuer undertakes because yous are practically borrowing your own money. They volition transport your monthly payment history to the credit bureaus so, using your bill of fare responsibly can make giant steps toward repairing your credit.

You should do this equally a last resort. These cards are notorious for their almanac fees and high-interest rates that could damage your finances even more in case you lag backside on your monthly payments.

When To Ask For Another Increase?

Even though your last request was denied, there is a good risk of blessing in some cases:

ane. Yous Already Have Adept Credit

If you take a expert credit score, it'south like saying to your issuer that y'all're a responsible borrower. Therefore, they can trust you to make your payments on time and be prudent in your use of the card. Although good credit does non necessarily hateful good fiscal health, creditors often wait at them as related. It's a practiced goal to have both.

2. Continual Use Of Credit Plus On-Time Payments

This is ane of the best ways to amplify your credit score and one of the certain means to go a credit limit increment. Your lender will run across that you accept been using your menu with care and paying off your balance with greenbacks for each argument period. Take a conservative approach when y'all request for a credit limit. Your issuer will decide based on your credit and how much increment y'all are requesting.

Don't shoot for the moon and enquire them to double your credit limit – meliorate aim betwixt a 10%-25% increase. Here's the catch: if you ask for also much so the issuer declines, you lot may need to wait for at least two or three months before you lot can ask again.

3. Your Income is Higher Now

An increase in your credit limit tin be benign after you lot've started earning more because your finances need to be more flexible. Let's say you beat out out $500 on average every month on a credit card with a $1,000 limit. Your credit utilization ratio will register at l%, which is higher up the benchmark of thirty%. If your limit climbs to $5,000 and you lot're even so spending $500 a calendar month, your utilization will become downward to ten%. This is excellent for your credit.

Source: https://infoforinvestors.com/credit-cards/guides-credit-cards/card-limit-increase-denied/

0 Response to "How Long After Denied to Ask for Credit Increase Again"

Post a Comment